》View SMM Lead Product Quotes, Data, and Market Analysis

》Subscribe to View SMM Historical Spot Metal Prices

》Click to View SMM Metal Industry Chain Database

According to an SMM survey, the cost differences among primary lead smelters mainly lie in smelting processing costs, raw material structure, procurement channels, and other factors.

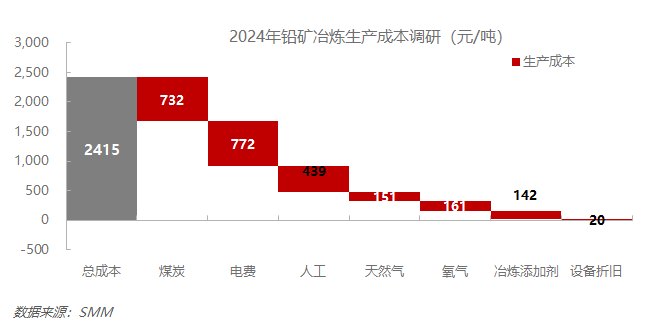

In terms of smelting processing costs, coal prices fell back from highs in 2023. As of December 17, 2024, the average price of SMM Grade 1 metallurgical coke in 2024 decreased by nearly 15% compared to the 2023 average. Additionally, with the completion of energy-saving technological transformations such as waste heat recovery and energy storage solutions at smelters, energy prices and costs are no longer frequently mentioned by lead smelters. Other cost components, such as labour, natural gas, oxygen, and smelting additives, showed no significant fluctuations. According to the SMM survey, although the raw material structure of domestic primary lead smelters varies greatly, the smelting process is relatively mature and stable. After multiple rounds of technological transformations, the process is primarily based on oxygen-enriched bottom-blowing furnaces equipped with independent oxygen production units, with some manufacturers adopting continuous furnace designs to reduce energy consumption.

Traditional lead smelting capacity uses lead concentrate with a grade of 45-55 as the production raw material. However, in 2024, with lead concentrate TC prices remaining low, some lead smelters reduced the feed grade of lead concentrate and increased the input of low-grade (35-45) lead concentrate containing associated multi-metals such as copper, zinc, and silver. The feed grade of lead affects lead recovery rates, thereby increasing the smelting cost per mt of lead metal but significantly improving the recovery efficiency and overall profitability of other valuable metals. In 2024, medium- and large-scale primary lead smelters and smelters with supporting multi-metal comprehensive recovery projects could fully offset lead smelting losses and maintain profitability through by-product profits and raw material procurement advantages. However, to ensure output value and profits, the feed grade of lead metal may decline, leading to reduced refined lead production. Therefore, except for a few manufacturers using crude lead, oxidized lead ore, or lead-zinc smelting recovery residues as raw materials, the estimated smelting processing cost for primary lead smelters in 2024 is about 2,000-2,500 yuan, slightly lower than in 2023. (March 2023 Lead Smelter Cost Curve and Profit-Loss Analysis [SMM Analysis])

Additionally, differences in raw material structure have caused significant variations in procurement costs. With the expansion and commissioning of comprehensive recovery projects and battery scrap dismantling projects at several smelters in Henan and Hunan, the proportion of non-lead concentrate raw materials in the feed of primary lead smelters is expected to rise to about 40% in 2024. During the peak season for battery scrap recovery, smelters in Henan mix lead-containing scrap and lead concentrate at a ratio close to 1:1. Several smelters also consistently procure lead-containing residues from tin-antimony and zinc smelting for blending and comprehensive recovery. Besides differences in raw material structure, procurement channels and equity structures of smelters also lead to significant variations in raw material procurement costs. Regarding imported ore, according to an SMM survey, about half of domestic enterprises are involved in imported ore procurement. In 2023, imported ore accounted for 33.59% of the total production volume of domestic smelters. In H2 2024, with the concentration of imported ore arrivals, the proportion of imported ore is expected to increase slightly by 2-3 percentage points. Furthermore, with the opening of the import window in 2024, smelters procuring imported ore gained better pricing opportunities, resulting in higher profits from imported ore smelting compared to 2023.

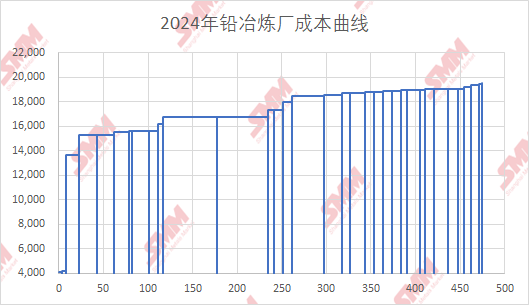

Based on the primary lead cost curve (including estimated raw material procurement costs), 37.3% of primary lead smelter capacity had costs moderately below the SMM 1# lead average price, while the remaining smelters experienced lead smelting losses ranging from 0 to 2,200 yuan/mt. Similar to previous years, lead smelting losses were mainly offset by comprehensive recovery and industry chain extension revenues. Additionally, the high silver prices in 2024 ensured stable refining profits for smelters. Looking ahead to 2025, lead smelting is expected to remain focused on the comprehensive recovery of silver, copper, zinc, and other rare metals. Although there is an anticipated increase in lead-zinc resource investments, the growth of multi-metal resources is relatively limited. The valuation of certain scarce resources has also been slightly adjusted, which may further widen the processing fee quotation differences for different types of lead ore raw materials. Due to differences in raw material structure and the degree of industry chain extension, the profitability of primary lead smelters varies greatly, with polarization becoming more pronounced.